Category: Articles

Your # 1 Resource for Residential, Multifamily and Commercial Real Estate Bridge Lending

Breaking News

DMAC Capital Funding Development, A Danny McKinney Design

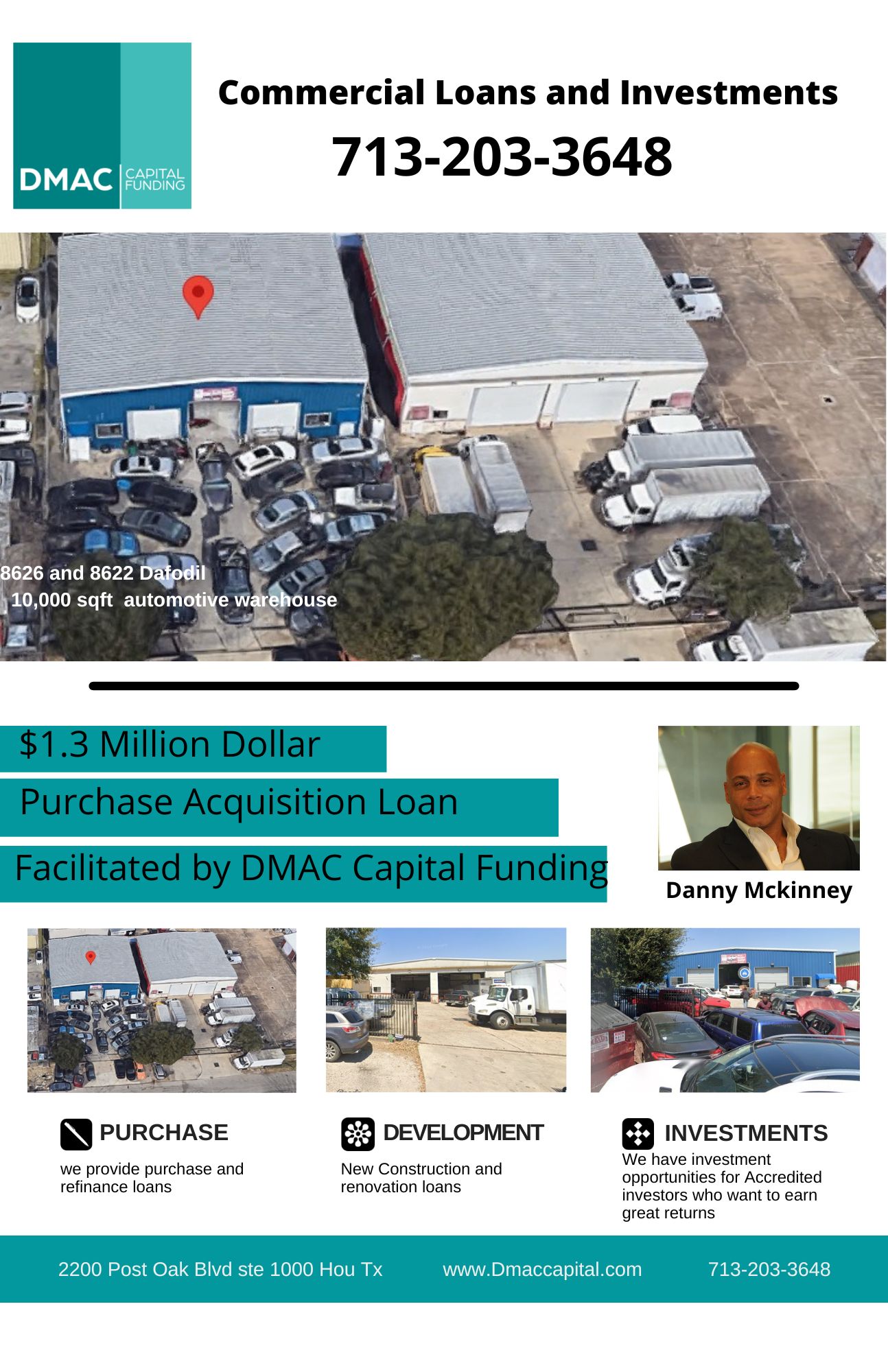

$1.3 Million Dollar Purchase Acquisition Loan

Ledet Hotel In Historic 3rd Ward Houston Texas

Invest with DMAC Capital Funding

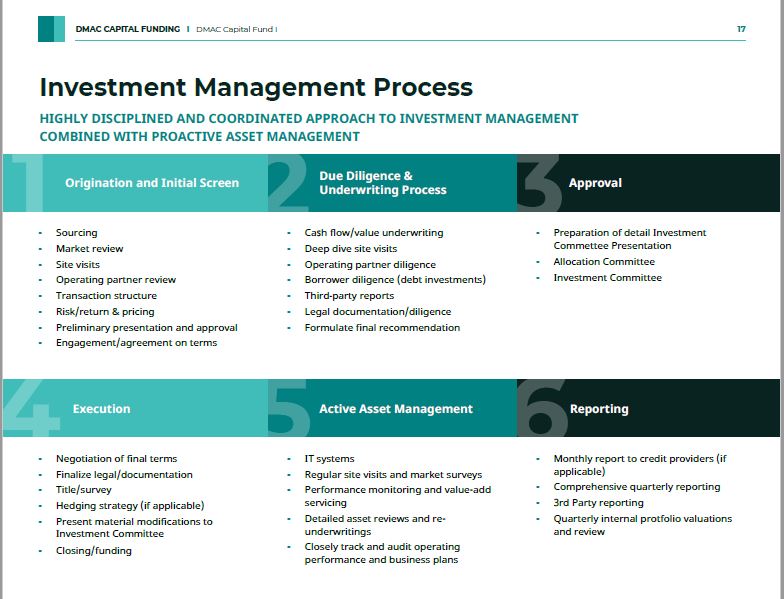

Investment Management Process

Commercial Loans and Investments

Invest with DMAC Capital

East Over Bullard Ave-$1.5 million development Funding secured by DMAC

DMAC Capital funding secured $1.5 million

DMAC CAPITAL FUNDING secured financing for East Over Land developer to begin home building in the once well know East Over subdivision. DMAC Capital Funding secured $1.5 million the developer to redevelop 70 lot section of the East Over know as Bullard Ave section.

This 70 acre lot was previously plotted for development prior to Hurricane Katrina. Since then the well know Plan unit has gone through renovations and rehabilitation of the current 300 home sites. Almost all have been rehabbed. The developer says “its time to finish what was started”.

EASTOVER, A unique pituresque gated community located approximately 12 miles from the french quarter and New Orleans Central Business District, Mercedes Benz Superdome and the Earnest N. Morial Convention Center. Within 25 miles of the Louis Armstrong International Airport and approximately 6 miles form the New Orleans Lakefront Airport.

Exhibiting custom homes with unique architectural details ranging from Acadian, Colonial, French Chateau, Southern, Victorian and Mediterranean style, This planned Unit Development is populated with approximately 300 home sites. Waterfront estates and scenic home sites are still available, as well as breathtaking views of nature-scape and scenic surroundings. Tranquility embraces residents within the gates of Eastover, The premium residential community in Eastern New Orleans.

DMAC Capital Funding is currently obtaining financing for the Eastover golf course. This 265 acre course which was once play by the masters is in need of renovation and a new club house. DMAC plans to secure funding within the next 30 days.

This is the beginning phase of a $35 million dollar development project

Danny Mckinney Has Leveled Up to FUND MANAGER at DMAC CAPITAL FUNDING

Real Estate Broker/ Investor and Lender Leveled Up to

Private Mortgage Lender & Fund Manager

HOUSTON, Texas — After 27 years, Danny Mckinney, JD, the curator an award-winning platform for real estate brokerage, investment and mortgage lending, has announced a $20 million Open-Ended Evergreen Fund positioning him as a real estate mogul on the move.

For almost three decades, Danny Mckinney has been a licensed real estate broker helping clients buy and sell their properties in addition to being an investor for nearly two of those decades. Danny, after completing law school in 1996, became the founder and CEO of Mckinney Real Estate & Investment Co. As the marketing and sales arm, he’s done over 350 million dollars in volume sales transactions combined as a broker and/or investor. He has also owned over 300 apartment units and built spec and custom homes.

To expand his reach and assistance to clients, Danny Mckinney, founded Diversified Home Mortgage in 1996. Danny and his team, has provided a diverse portfolio of loan products for his clients. From FHA, VA, conventional, jumbo and nontraditional loan programs such as hard money and private money loans. They have closed and funded over 300 million dollars in mortgages. Danny believes, “if you control the money you control the deal!”

The establishment of DMAC Capital Fund was naturally the next step. As a multi-million dollar funding platform, DMAC Capital Funding is a private commercial real estate lender whose primary objective is to meet the needs of our clients for short-term bridge or equity financing with efficiency, flexibility, and professionalism. DMAC Capital Funding provides capital in short-term loans and equity financing for Commercial and Residential Real Estate Investment.

“YOUR MONEY SHOULD BE MAKING DOUBLE DIGIT RETURNS”

Danny McKinney and his enterprises, continues to rapidly grow in the real estate arena and a CEO to watch.

Steady as she Goes-Texas Apartment Markets Recovering

Market analysis done by Texas A&M University real estate center

How To Apply for a Bridge Loan with DMAC CAPITAL FUNDING

Is the Houston Apartment Market Hot or Not?

Check out what Transwestern has to say about the Houston Market